Note: This section contains information in English only.

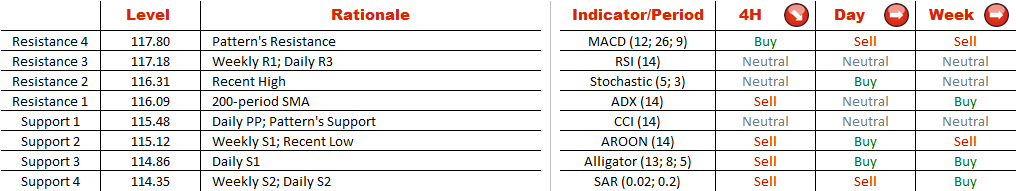

CHF/JPY is likely to be highly volatile soon, as the pattern is approaching the apex point, while just recently bears made an attempt to penetrate the support line. Despite the move back into pattern's boundaries, technicals on the 4H chart are sending ‘sell' signals, pointing at pair's further depreciation. In a longer-term, the pair is likely to move sideways, as indicators on a daily and weekly charts are neutral. The short-term outlook is bearish, as together with technicals, 71% of traders are holding short positions on the pair. The key level for short traders is located at a recent low and a weekly S1 at 115.12. Without any substantial bearish bias, the pair will bounce back.

CHF/JPY is likely to be highly volatile soon, as the pattern is approaching the apex point, while just recently bears made an attempt to penetrate the support line. Despite the move back into pattern's boundaries, technicals on the 4H chart are sending ‘sell' signals, pointing at pair's further depreciation. In a longer-term, the pair is likely to move sideways, as indicators on a daily and weekly charts are neutral. The short-term outlook is bearish, as together with technicals, 71% of traders are holding short positions on the pair. The key level for short traders is located at a recent low and a weekly S1 at 115.12. Without any substantial bearish bias, the pair will bounce back.

Wed, 09 Apr 2014 13:44:05 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.