Note: This section contains information in English only.

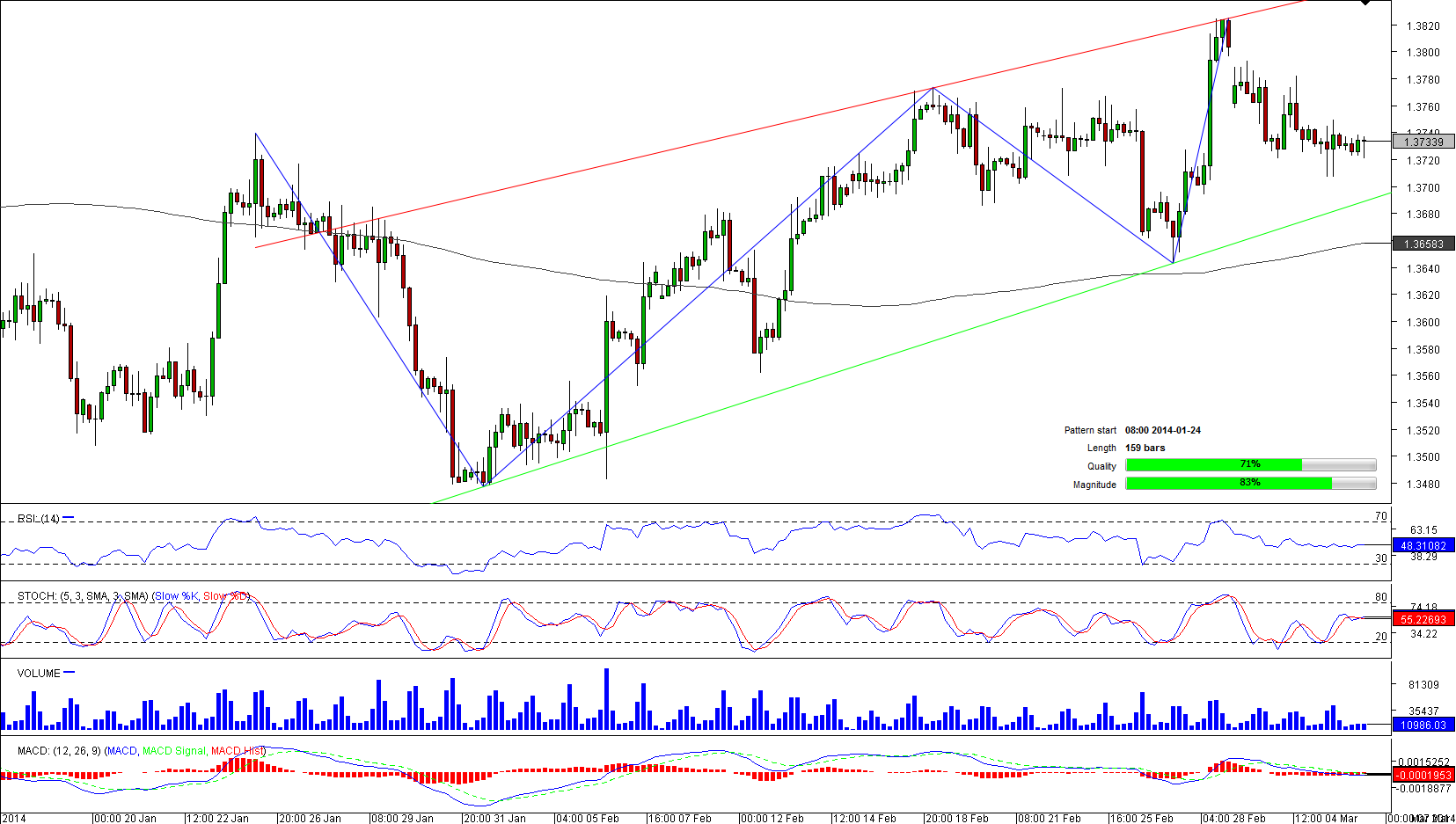

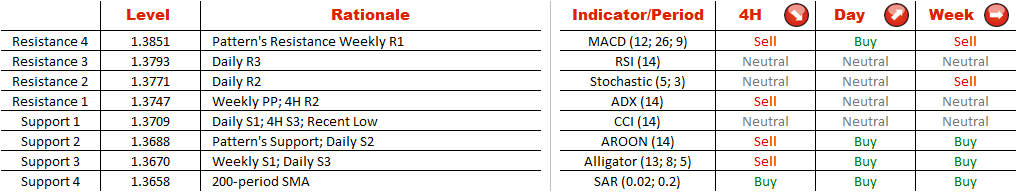

In a longer-term the most traded currency pair is trading between two Fibonacci retracements– at 1.3894 and 1.3456. In a shorter-term, however, the pair is moving in boundaries of a rising wedge pattern that was formed on January 24. The pair will affected by vital fundamental data from the United States and Europe this week, while traders believe the pair is overbought, hence, opening short positions. While 58% of opened positions are short, 62% of pending orders in a 100-pip range are placed to sell the Euro against the U.S. Dollar, therefore, the outlook is bearish. In case 1.3709 is breached, pattern's support and a daily S2 at 1.3688 will be put on the map.

In a longer-term the most traded currency pair is trading between two Fibonacci retracements– at 1.3894 and 1.3456. In a shorter-term, however, the pair is moving in boundaries of a rising wedge pattern that was formed on January 24. The pair will affected by vital fundamental data from the United States and Europe this week, while traders believe the pair is overbought, hence, opening short positions. While 58% of opened positions are short, 62% of pending orders in a 100-pip range are placed to sell the Euro against the U.S. Dollar, therefore, the outlook is bearish. In case 1.3709 is breached, pattern's support and a daily S2 at 1.3688 will be put on the map.

Thu, 06 Mar 2014 11:56:31 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.