Note: This section contains information in English only.

Thu, 20 Feb 2014 07:46:10 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

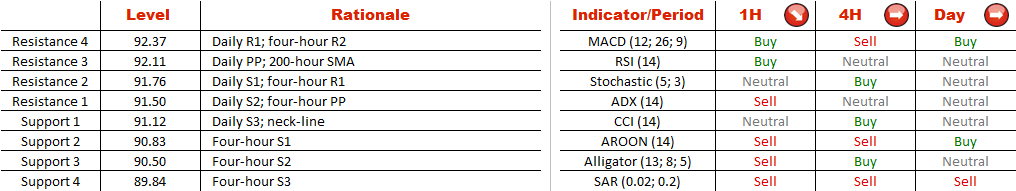

Being that an up-move observed in the first half of February has already twice failed at the level of 93, we may assume that AUD/JPY has formed a double top pattern that in turn increases the chance of a sharp decline in the nearest future. This pattern also implies a neck-line at 91.12, which needs to be breached for the bearish potential to be fully realised.

Ultimately, the sell-off may extend down to 88.24, Feb 3 low, considering that there are no important supports below the neck-line, only a few four-hour pivots. However, we must notice that the traders' sentiment is explicitly bullish—73% of open positions are presently long.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.