Note: This section contains information in English only.

Soon after breaching the 200-period SMA on Jan 2, USD/CHF returned back to the long-term moving average, where it received enough bullish impetus to start yet another recovery.

Soon after breaching the 200-period SMA on Jan 2, USD/CHF returned back to the long-term moving average, where it received enough bullish impetus to start yet another recovery.

Tue, 21 Jan 2014 11:46:21 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

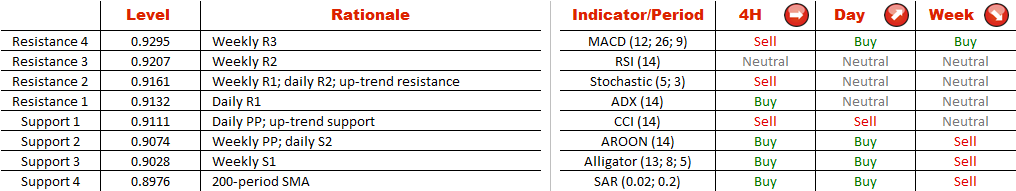

As it turns out, this rally is developing into a rising wedge pattern, implying that the currency pair at the moment is facing a strong resistance area and thereby is likely to fall precipitously in the nearest future. Still, for the bearish scenario to materialise, the price has to settle beneath the up-trend support line at 0.9111 that for now remains intact. If this is the case, the rate will be expected to plummet through the closest supports until it again reaches the 200-period SMA at 0.8976.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.