Note: This section contains information in English only.

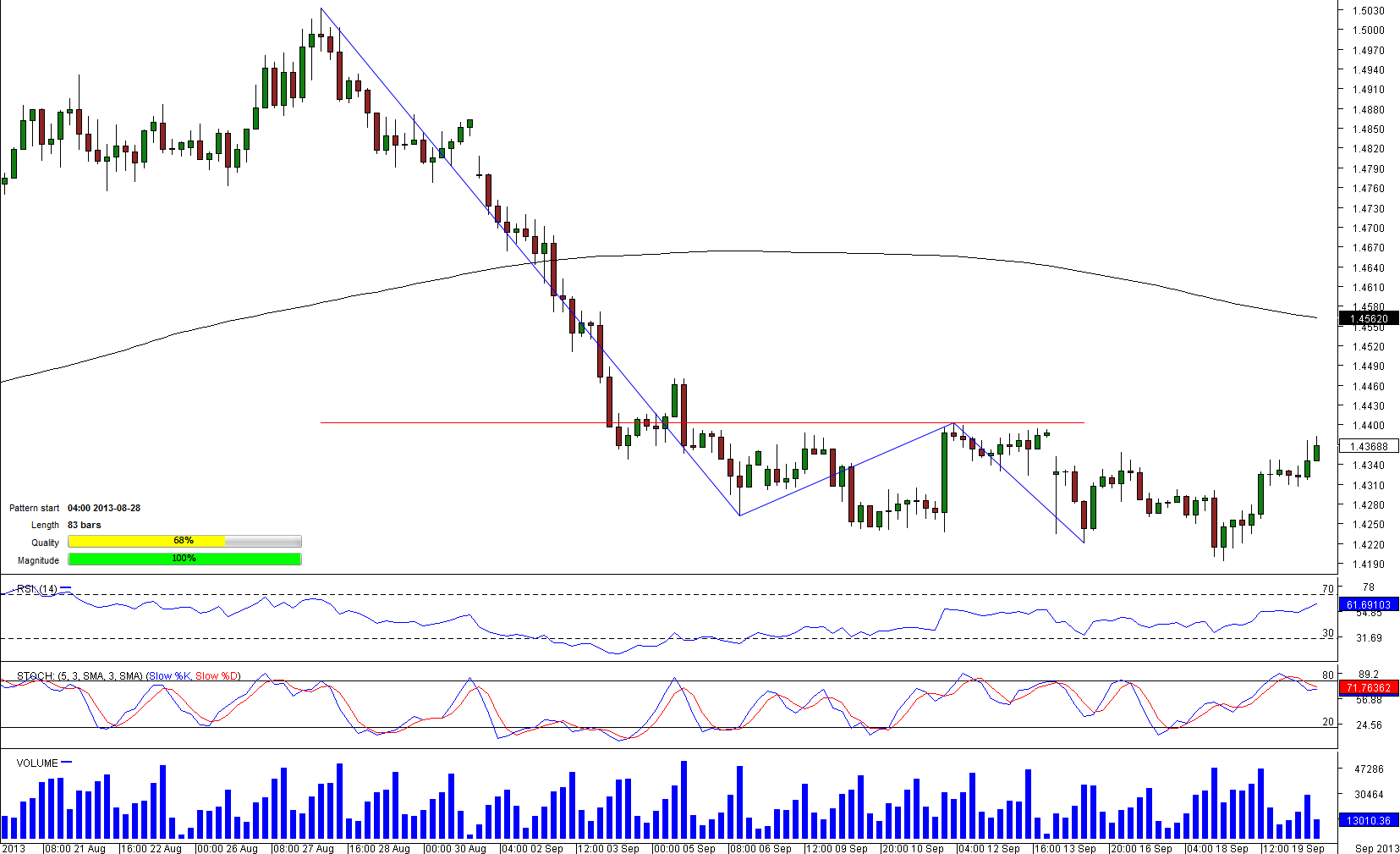

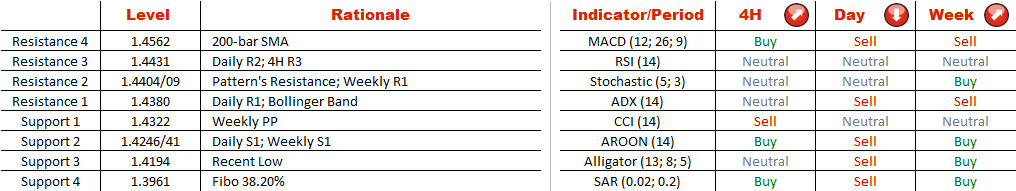

After peaking at 1.503 on August 28, a level that was the highest since May 2009, the pair has began its depreciation and formed a double bottom pattern. Usually, this pattern is characterised by a strong bottom line, which is in our case located around 1.42. The fact that each new low was lower than the previous one is bolstering a view of a possible downside breakout. Moreover, double bottoms are usually formed after a period of long depreciation when the pair moves sideways for some time. The idea of a downside movement is supported by daily technical indicators, however, technicals on 4H and weekly charts are pointing into opposite direction.

After peaking at 1.503 on August 28, a level that was the highest since May 2009, the pair has began its depreciation and formed a double bottom pattern. Usually, this pattern is characterised by a strong bottom line, which is in our case located around 1.42. The fact that each new low was lower than the previous one is bolstering a view of a possible downside breakout. Moreover, double bottoms are usually formed after a period of long depreciation when the pair moves sideways for some time. The idea of a downside movement is supported by daily technical indicators, however, technicals on 4H and weekly charts are pointing into opposite direction.

Fri, 20 Sep 2013 13:51:25 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.