Note: This section contains information in English only.

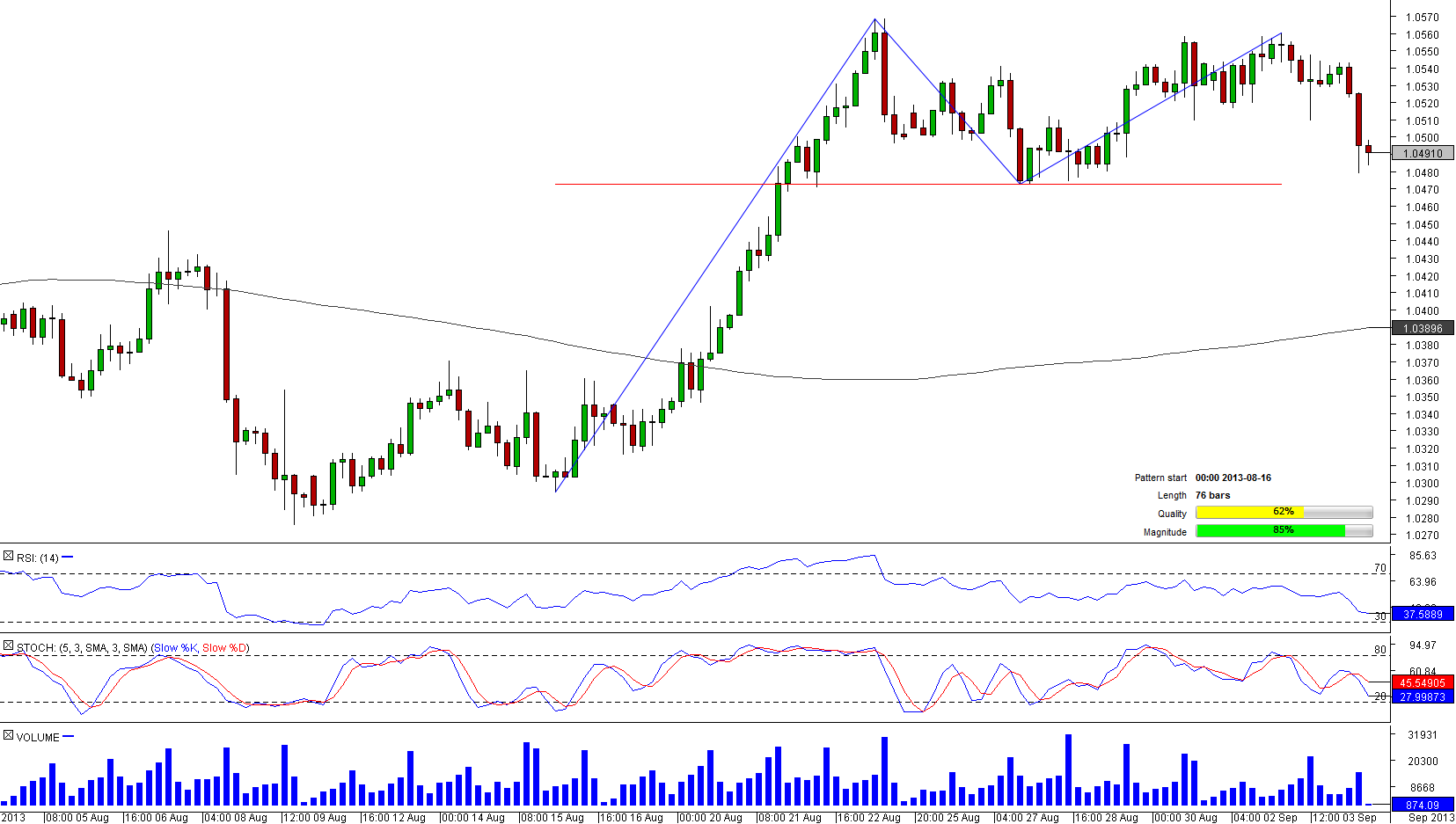

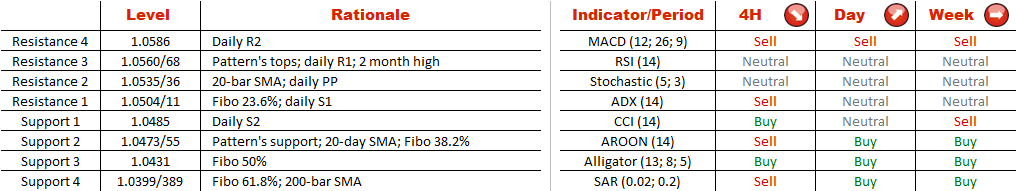

Greenback-loonie cross is posing for approximately 200 pip depreciation. It is the main implication behind the Double Top patterns—pair fails to reach new (relative) high and gradually returns to the previous trading levels. We have observed a rather sharp, 65 pip, sell off in the last 8-12 hours and we should see a minor bullish correction due to this (bounce from the daily S2). It seems that Fibonacci retracements of the initial rally (16th to 23rd of August) have significant impact on the pair—23.6% retracement kept the pair checked from 23rd to 29th of August.; 38.2% retracement is just slightly below the pattern's support.

Greenback-loonie cross is posing for approximately 200 pip depreciation. It is the main implication behind the Double Top patterns—pair fails to reach new (relative) high and gradually returns to the previous trading levels. We have observed a rather sharp, 65 pip, sell off in the last 8-12 hours and we should see a minor bullish correction due to this (bounce from the daily S2). It seems that Fibonacci retracements of the initial rally (16th to 23rd of August) have significant impact on the pair—23.6% retracement kept the pair checked from 23rd to 29th of August.; 38.2% retracement is just slightly below the pattern's support.

Wed, 04 Sep 2013 13:47:19 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.