Note: This section contains information in English only.

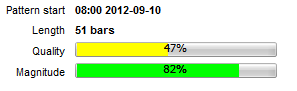

USD/JPY has formed a Channel Up pattern on 4H chart. The pattern has 47% quality and 82% magnitude in the 51-bar period.

USD/JPY has formed a Channel Up pattern on 4H chart. The pattern has 47% quality and 82% magnitude in the 51-bar period.

Fri, 21 Sep 2012 13:23:56 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

The pattern started when the pair started depreciating from 78.337. Currently the pair is trading at pattern's support/Fibonacci (50% of move since 13th of September) at 78.175. The SWFX market sentiment is bullish—71% of all of positions are long expecting that the pair will follow pattern's, upward sloping, trend. In addition, in the range of 200 pips from current market price 72% of all pending orders are buy orders. Long traders could focus on Fibonacci (38.2%)/daily pivot (R1)/20 bar SMA at 78.437/58, 200 bar SMA at 78.564 and daily pivot (R2)/Fibonacci (23.6%) at 78.680/737.

Technical indicators on aggregate point at depreciation of the pair on 4H, 1D and 1W time horizons suggesting that we should see a bearish rally in the near future in the pair.Short traders could focus on recent (20th of September) pattern's support test level/daily pivot (S1) at 78.026/007, Fibonacci (61.8%)/Bollinger's band at 77.925/907 and daily pivot (S2) at 77.795.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.