Note: This section contains information in English only.

Wed, 01 Aug 2012 06:53:07 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

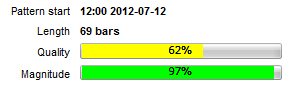

GBP/USD is slowly appreciating and has formed a Channel Up pattern on the 4H chart. The pattern has 62% quality and 97% magnitude in the 69-bar period.

The pattern started when the pair bounced from 1.5394 and after testing pattern's resistance band at 1.5738 and 1.5768 the pair slowed down at 1.5671 where the pair is currently trading. Long traders, who expect that the pair will bounce from SMA200 and will continue to follow pattern's trend, could set the first target at the recent peak at 1.5731. If this level is breached, next targets could be at the recent pattern's resistance test level at 1.5768 and, if the pair gains momentum, at the patterns resistance band at 1.5787.

Technical indicators on aggregate on 4H and 1W time horizon and the stochastic indicator on 1D outlook send sell signals. The SWFX market sentiment shows that 56% of traders expect depreciation of the pair. Short traders should focus on the 31st of July low at 1.5626. If this level is breached next targets could be at SMA200 1.5606 and, if the pair gains momentum as it did on 26th of July, at the pattern's support band at 1.5500.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.