Short traders expecting negative fundamental news from the US could focus on the pattern's lower band at 79.217. If the pair breaches this level, next possible targets could be set at the daily support levels (Fibonacci) at 79.130 and 78.931 where we could see a pullback.

Note: This section contains information in English only.

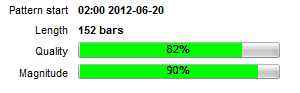

USD/JPY has slowed down after a rapid gain from 20th to 24th of June and has formed a Descending Triangle pattern on the 1H chart. The pattern has 82% quality and 90% magnitude in the 152-bar period.

USD/JPY has slowed down after a rapid gain from 20th to 24th of June and has formed a Descending Triangle pattern on the 1H chart. The pattern has 82% quality and 90% magnitude in the 152-bar period.

Short traders expecting negative fundamental news from the US could focus on the pattern's lower band at 79.217. If the pair breaches this level, next possible targets could be set at the daily support levels (Fibonacci) at 79.130 and 78.931 where we could see a pullback.

Fri, 29 Jun 2012 05:22:22 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

The pattern started when the pair bounced from 78.791 and after testing resistance levels at 80.619 and at 79.864. it has slowed down at slightly below SMA 200 at around 79.3 where the pair is currently trading. The patterns support band is at 79.217 and is scheduled to intersect with resistance line on 29th of June at 20:00 GMT. The RSI on the 1D time horizon suggests a possible bull market outbreak. The SWFX market sentiment is in favor for the bulls with 70% of traders expecting the pair will continue its recovery. Long traders could focus on the daily resistance (Fibonacci) level at 79.4026. If this level is breached, next targets could be at 79.467 and around SMA200 at 79.6.

Short traders expecting negative fundamental news from the US could focus on the pattern's lower band at 79.217. If the pair breaches this level, next possible targets could be set at the daily support levels (Fibonacci) at 79.130 and 78.931 where we could see a pullback.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

订阅

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

欲了解更多有关杜高斯贝银行差价合约/外汇交易平台,SWFX和其它相关交易详情,

请致电我们或要求回电。

请致电我们或要求回电。

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.