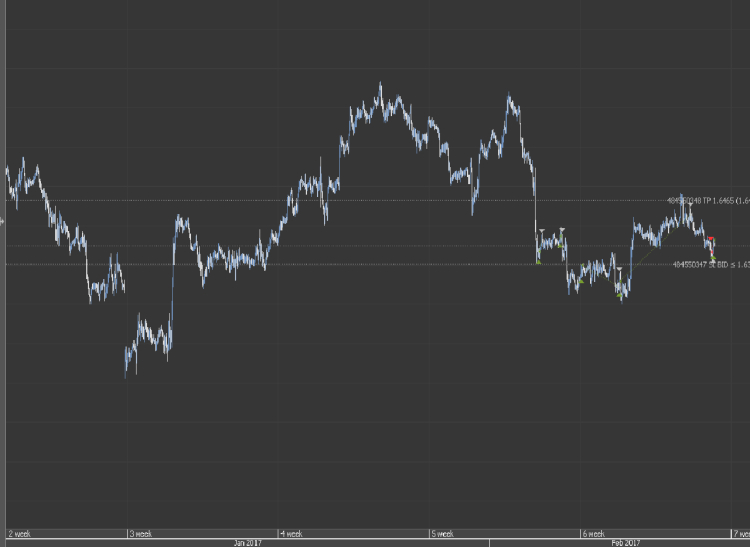

Economists expected to see CPI rise 1.9% instead. The British pound came under pressure with a stronger US dollar, closing the day at $1.2468.

Price action continues to trade rather flat with $1.2400 support remaining in sight.

After today softer UK wages we can expct the GBP to continue declining, going short if 1.2400 gets brea…

RedPhoenix

RedPhoenix