Note: This section contains information in English only.

Mon, 30 Apr 2012 10:04:44 GMT

Source: Dukascopy Bank

© Dukascopy Bank

"The latest economic statistics suggest that the international economic recovery will continue, although growth rates are likely to be on the low side by comparison with typical recovery phases"

- Swiss National Bank (based on CNBC)

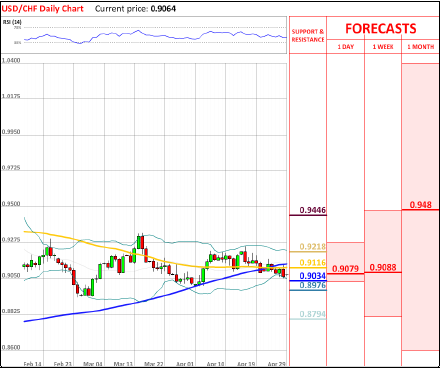

As the currency pair currently remains under the downward pressure, 0.9066—Friday's key support—is being tested at the moment. If this level is successfully pierced, 0.9000 and 0.8933 (200 day ma) could become the next targets in focus. However, in case these supports are tested, a positive outlook is likely to be restored and then the focus could be shifted to the 0.9317/42 area.

USD/CHF currency pair remains overbought, as long positions compose the market by 71.47%, while the portion of short positions is currently 28.53%.

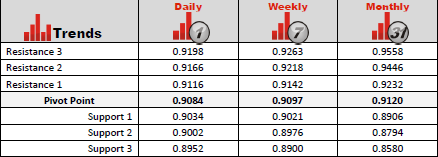

Investors should pay attention to the identified with the help of the standard pivot point method resistance zones, as they might be useful during intraday trading. The initial resistance level is at the level of 0.9116, whereas R2 and R3 are situated at 0.9166 and 0.9198, accordingly.

Largest investors might have placed their take profit orders at the key support levels. These levels for intraday trading are situated at 0.9034, 0.9002 and 0.8952.

© Dukascopy Bank

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscrever

Para saber mais sobre a plataforma de negociação Dukascopy Bank CFD / Forex, SWFX e outras informações relacionadas com negociação,

por favor entre em contato conosco ou faça um pedido de retorno de chamada.

por favor entre em contato conosco ou faça um pedido de retorno de chamada.

Para obter mais informações sobre uma potencial cooperação,

ligue-nos ou faça-nos um pedido para ser contactado.

ligue-nos ou faça-nos um pedido para ser contactado.

Para saber mais sobre as opções binárias do Dukascopy Bank

/ Plataforma de negociação Forex, SWFX e outras informações relacionadas com Trading,

ligue-nos ou faça-nos um pedido para ser contactado.

ligue-nos ou faça-nos um pedido para ser contactado.

Para saber mais sobre a plataforma de negociação Dukascopy Bank CFD / Forex, SWFX e outras informações relacionadas com negociação,

por favor entre em contato conosco ou faça um pedido de retorno de chamada.

por favor entre em contato conosco ou faça um pedido de retorno de chamada.

Para saber mais sobre a plataforma de Trading / Trading de Crypto/ CFD / SWFX e outras informações relacionadas à negociação,

ligue-nos ou faça-nos uma pedido para ser contactado.

ligue-nos ou faça-nos uma pedido para ser contactado.

Para saber mais sobre o programa de Introdutor de Negócios e outras informações relacionadas à negociação,

ligue-nos ou faça-nos uma pedido para ser contactado.

ligue-nos ou faça-nos uma pedido para ser contactado.

Para obter mais informações sobre uma potencial cooperação,

ligue-nos ou faça-nos um pedido para ser contactado.

ligue-nos ou faça-nos um pedido para ser contactado.