There are many structural reasons that support a dollar bullish trend in the coming years. The outstanding US Dollar short positions are enormously. And a bearish trend doesn't stops because there will be a mythical big buy position that will reverse the trend.

There are many structural reasons that support a dollar bullish trend in the coming years. The outstanding US Dollar short positions are enormously. And a bearish trend doesn't stops because there will be a mythical big buy position that will reverse the trend. A bearish trend will reverse when all the

sellers who wanted to sell are in the market and there is no one left to sell. The same is the case with a bullish trend which will not reverse because some huge sell will come in the market but because there are no more buyers to lift the market.

So in our case it will not be a bullish dollar trend because some positive reasons. It will be the outstanding US Dollar short positions which are going to create the bullish trend least expected. It will be the biggest squeeze of our lifetime and when this short position will feel the pain of market going against them they will fuel the market new trend as they will be forced to buy back their shorts, which in turns will add more power to the new bullish trend.

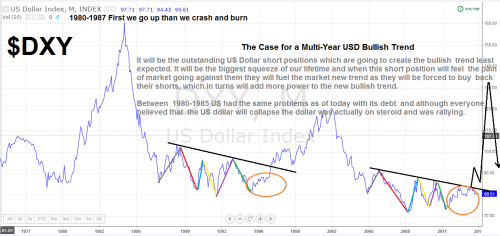

The history does repeat itself put it never strike twice in the same place, like chart patterns. Knowing what has happened in the past can give you a guide of what might gonna come. Don't forget that between 1980-1985 the USA had the same problems as of today with its debt and although everyone believed that the US dollar will collapse the dollar was actually on steroid and was rallying (see Figure 1).

- Figure 1. The case for a multi-year USD Bullish trend (click on the picture to enlarge).

The thing that will start US dollar rally will be a rise in interest rates only than the short squeeze rally will begin and will wipe out the short US dollar positions. We are going to have a squeeze on both side of the market like in the 1980-1985 first we are going to go up and only than we can crash and burn. We can't crash and burn from current levels it always must be from the highs.

If you look around the world you will see that everyone is imploding and the trust in governments is declining at alarming speed and capital flows is shifting from public to private that's one of the reasons why US stock market are still rallying. And this will be the trigger point fro the raise in interest rates --> dollar rallying. The only currency that can absorb huge quantity of money remains the US dollar, it has huge liquidity. The euro can't replace the dollar because of the structural problems and its failure to create a single debt.Can you see the symmetry in Figure 1 the trigger point for the new US dollar bull trend will be when we are going to break the black TL like it was the case in 1998.

Best regards,

Daytrader21.