© Dukascopy

"The U.S. dollar would get some support in this environment particularly, as the euro is out of favor"

- St. George Bank Ltd. (based on Bloomberg)

Industry outlook

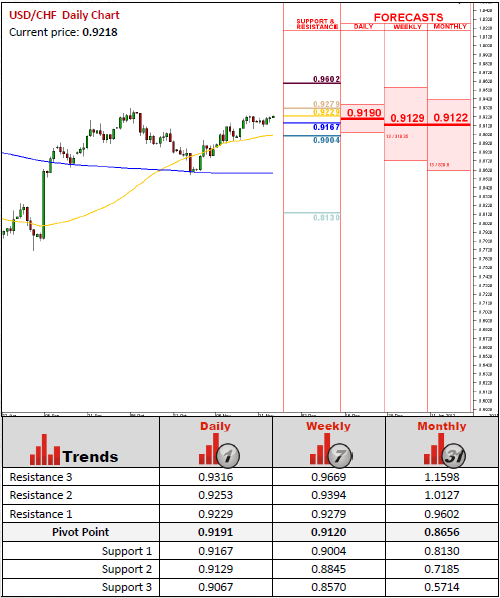

Present bullish impetus is expected to drag the price rather high - up to 0.9317 and ultimately up to 0.9341/99 where the latter level is likely to act as impenetrable impediment. Supports, on the other hand, lie at 0.9120 and 0.8555/50.

Traders' sentiment

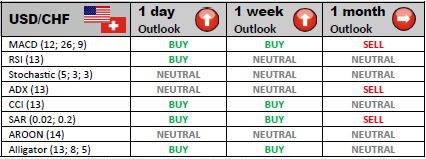

More market participants believe in greenback's appreciation relative to the swissie than they did yesterday morning. The part of long trades surged to 66.01%, while the share of short trades tumbled to 33.99%.

Long position opened

Major market participants are likely to close their long positions at the key resistance levels. The primary short-term target will be reached at 0.9229. The breakout of this level will pave a way for a bullish run up to 0.9253 and then to 0.9316.

Short position opened

In case of dips, another rally may start after rebounding from the initial support level at 0.9167. However, assuming that the bearish momentum does not weaken, investors will pay attention to the lower support levels at 0.9129 and 0.9067.

© Dukascopy