Hi!

I'll try to bring more light on this:

Quote:

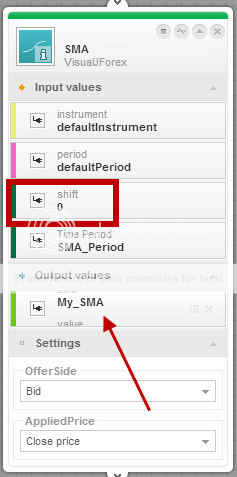

1) Here - do we have a value that is fluctuating? (because the SMA shit is zero)

SMA shift is 0 --> SMA value corresponds to the current fluctuating value that will remain moving till the candle is finished BUT this depends on how your indicator is plugged and what condition(s) is (are) implemented before it:

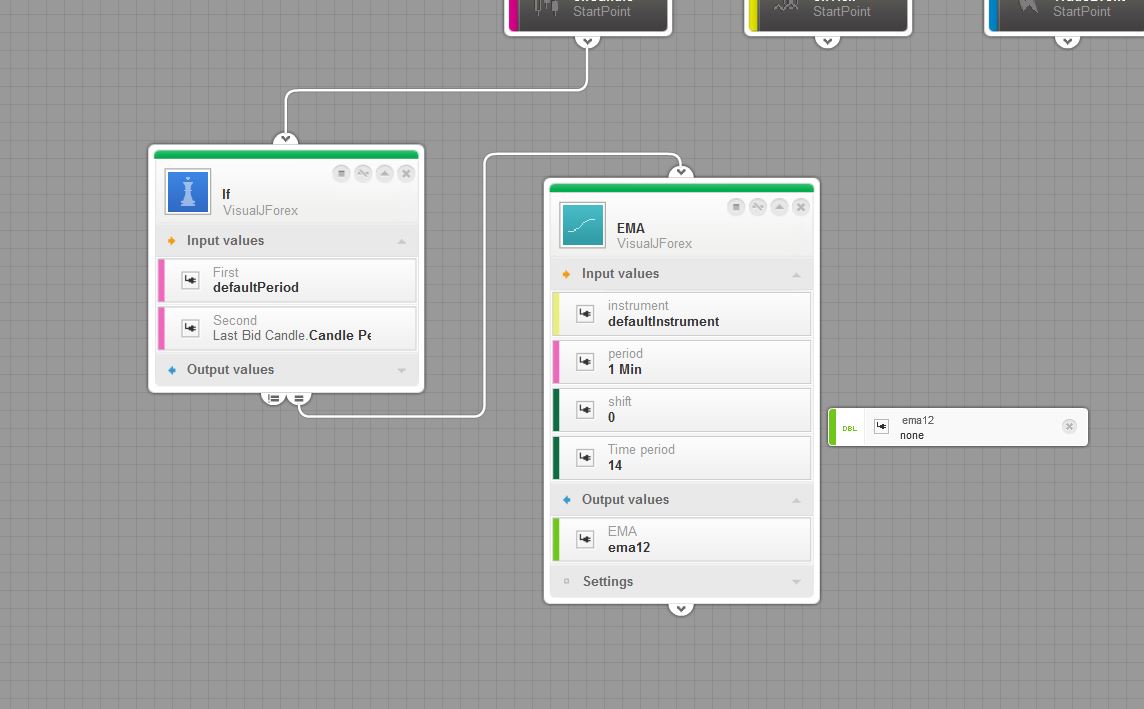

Example1 :

you have an ema plugged with a period filter that will allow the flow to go IF the period is = to One minute. In other words, any conditions or block that sits after this will be checked-executed every minute. In this case, with your EMA shift 0 one the very first tick of the new 1mn candle starts, the output of the EMA will correspond to the current value of the indicator at the open price of the candle (the very first tick) So the current value of the EMA is the one been "catch" when the candle starts.

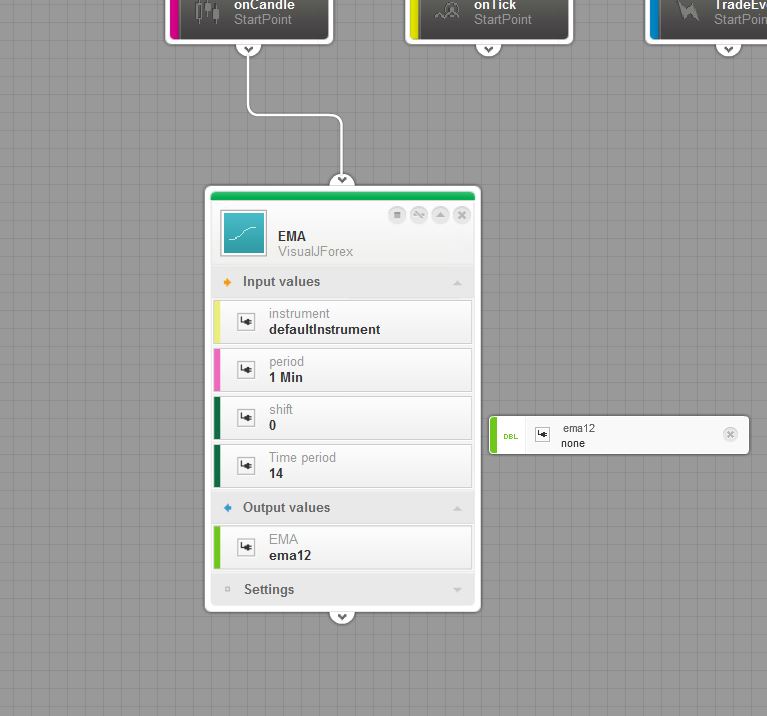

Example 2:

This is an EMA plugged straight to the OnCandle start point which by the way will be executed at any candle period starting from the minimum one (10sec) till the maximum (Month).

So every 10 sec, the system will proceed and the flow will go through the EMA block and the output will show the value of the current EMA every 10 sec. SO it is a kind of snapshot every 10 sec of the fluctuating value of the EMA

built on 1 mn period.

Many other examples can be configured such as a filter of 1 mn plugged to an EMA with period of 15mn for instance. this will optimize the system checks if you need frequent verification of the current EMA value, so basically you'll get the current snapshot of the EMA built on 15mn candles every 1mn of time.

Quote:

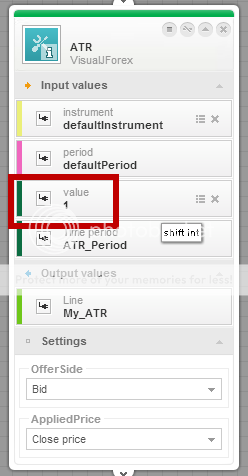

2) And here - do we have a value that is fixed? (last candle of default period)

As long as the shift value is 1 and greater, we are looking to a past value of the indicator which is already calculated and defined upon the period selected. The value is then fixed and ready to be used or called for any-further condition. You can still check this past value in a chart with the same indicator drawn.

Quote:

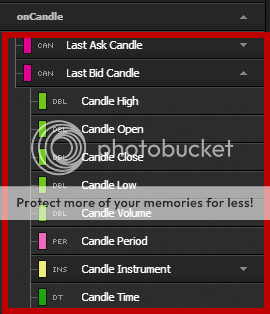

3) And here we have fixed values of last candle of default period.

No same as 1, these are the current candle's OHLC which still moving

except the Open price which already determined when the candle starts. You can play with these variables by changing the default period applied and drag them into the work-space a conduct a real time run. You'll see the High, low and close price moving.

Hope this helps ..

A